Are you a business owner who needs to know more about the W-9 tax form? If so, you’ve come to the right place! This blog post will guide you through everything you need about this confusing document.

This article will provide everything you need to understand its purpose and significance better, from why it’s important, how it is used, and what information is included on the form.

Plus, we'll give some tips for filling out your W-9 quickly! Get ready to become as knowledgeable as an accountant in just one reading session with our easy-to-follow advice today!

Overview of W-9 tax form and what it is used for

A W-9 tax form is an IRS document used to report income from non-employees. It is typically completed by independent contractors or freelancers, allowing the company that hired them to withhold the correct federal income and Social Security taxes from their payments.

The form lists the contractor’s name, address, taxpayer identification information, and other necessary information, such as the type of business they are providing services for. When you receive a W-9 request, completing the form is important so your employer can correctly withhold taxes from your paycheck.

A W-9 tax form also allows employers to properly track and report income on annual reports such as Form 1099-MISC or Form 1099-K. This information is then used to report income to the IRS for tax purposes, so the form must be filled out correctly and completely.

Filling out a W-9 tax form isn’t difficult, but there are a few key points to remember. First, ensure all your personal information on the form matches the information you have reported to the IRS.

Additionally, be sure all amounts listed are accurate; if they don't match what your employer has on record, you could face hefty fines from the IRS! Finally, please double-check that you've signed and dated your completed form before submitting it to your employer.

Who should fill out a W-9 tax form

Anyone who provides services as an independent contractor or freelancer in the US must complete a W-9 tax form. This includes freelancers, writers, virtual assistants, photographers, graphic designers, and software developers.

It also applies to business owners who provide services to other businesses and receive payments for those services through 1099-MISC forms.

The same is true for vendors who process payments via credit card and receive Form 1099-K from their payment processors. The IRS considers These individuals non-employees and must provide a valid W-9 tax form before being paid.

It's important to note that companies are not required to complete the form on behalf of their independent contractors or freelancers; rather, the contractor is responsible for providing it. Additionally, you're a business owner responsible for hiring independent contractors.

In that case, you should ensure they have completed and submitted a valid W-9 tax form before paying them. Failing to do so can result in fines from the IRS.

When to complete a W-9 tax form

The W-9 tax form should be completed and submitted to your employer or client as soon as you begin working for them. This will give them the information needed to withhold the correct taxes from your payments. The form should also be updated whenever your personal information changes.

Filling out a W-9 tax form may seem daunting at first, but it's important to remember that this document is necessary for reporting non-employee income accurately and correctly.

If you're unsure how to proceed, consult an accountant or a qualified tax attorney who can help guide you. So don't wait any longer - get started on your W-9 tax form today!

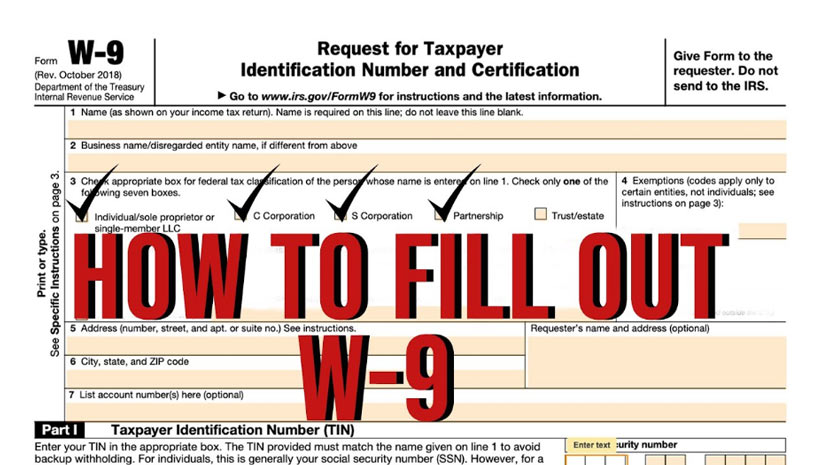

Way to correctly complete a W-9 tax form

Completing a W-9 tax form ensures that your employer has accurate information for reporting your non-employee income. First, ensure all the personal details listed on the form match what you’ve provided to the IRS, such as your name and address. You should also double-check that any amounts entered are correct; if they don't match your employer's records.

To correctly fill out the W-9 tax form, you must provide accurate information for each field listed on the form. Your name should match exactly what is listed on your Social Security card or other verified identification documents; this includes middle initials if applicable.

You should also ensure the address you list is up to date-and accurate. If your business has a separate mailing address from your home address, be sure to add that as well.

The taxpayer identification number is typically your Social Security number (SSN) or individual taxpayer identification number (ITIN). For an LLC, partnership, corporation, or association, it will likely be an employer identification number (EIN). It's important to ensure this information is correct, as incorrect information can delay the filing or distribution of payments.

The information needs to be included on the W-9 tax form

The information required on the W-9 tax form includes your legal name, address, taxpayer identification number (Social Security number or EIN), and entity type you’re filing as.

Additionally, depending on the business type, you may have to check certain boxes in the “Exemptions” section at the top. This exemption applies to those not subject to backup withholding, such as churches and non-profits.

Once all of your information has been filled out correctly, please double-check that you've signed and dated the form before submitting it to your employer. If this information changes in subsequent years, update your W-9 accordingly.

Common mistakes to avoid when filling out the W-9 tax form

The most common mistake when filling out the W-9 tax form is providing accurate or complete information. Additionally, some employers may ask for a copy of your driver's license or other form of identification; the IRS does not require this and should be declined.

It’s also important to note that you should never sign a blank W-9 tax form, which can leave you vulnerable to identity theft. Finally, ensure that all amounts listed are correct. Incorrect amounts can lead to fines from the IRS, so double-check before submitting your completed form.

FAQs

Q: How is a W-9 tax form used?

A: As previously mentioned, businesses use the W-9 form to properly report payments to independent contractors or non-employee workers. The IRS uses this form to verify the contractor’s information, such as their name and taxpayer identification number (TIN).

Businesses also use it to provide contractors with an accurate accounting of all payments made during a given tax period. This ensures that both parties have accurate records come tax time.

Q: What information does a W-9 include?

A: Generally speaking, a W-9 includes the following information:

• Contractor's Name

• Contractor's Address

• Taxpayer Identification Number (TIN)

• Type of TIN used (i.e., Social Security Number or Employer Identification Number)

• Certification statement that the contractor is not subject to backup withholding

• Any exceptions from backup withholding requirements (if applicable).

Q: What tips do you have for filling out a W-9?

A: Filling out your W-9 form can be a simple process. Here are some helpful tips for ensuring that yours is filled out correctly and efficiently:

• Make sure all of the information provided is accurate and up-to-date. This includes your name, address, and TIN.

• Double check that you have signed the form in the appropriate areas, as this is required by law.

• Be aware of any exceptions from backup withholding requirements, as these apply only to certain types of payments.

Conclusion

By understanding the purpose and significance of the W-9 tax form, businesses can ensure they are properly filing payments to their independent contractors.

This guide has provided an overview of why it’s important, how it is used, what information is included on the form, and some helpful tips for filling out your W-9 quickly! With this newfound knowledge, you can take all the right steps toward getting started with your W-9 filings today.