Are you seeking financial independence and need to know how to start? Making decisions about investing can feel daunting, but managing your risk tolerance is the ideal place to begin.

Risk tolerance is an individual's attitude towards the level of monetary uncertainty or volatility they are willing and able to take regarding investment opportunities.

This blog post will explore risk tolerance, its importance in successful investing, and useful tips on adapting your risk profile accordingly. Read more for everything you need to know about defining your risk tolerance!

Defining Risk Tolerance

The level of investment return volatility that an investor is willing to accept is known as risk tolerance. The level of risk that an investor may tolerate on an emotional and financial level is known as risk tolerance. It is also known as one's capacity for risk or appetite for risk.

Understanding Risk Tolerance

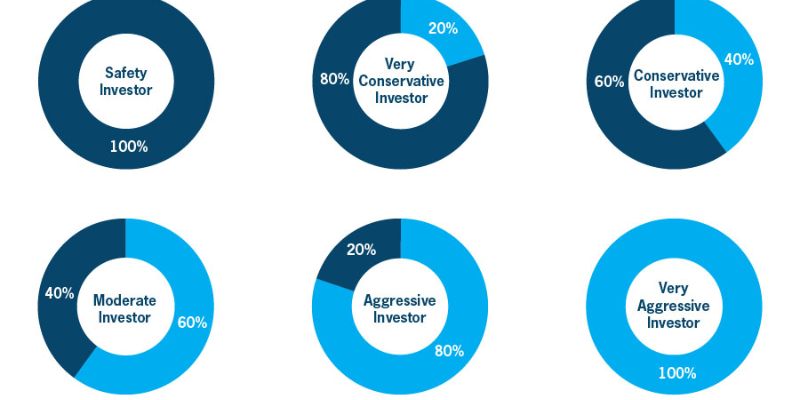

It is important to understand risk tolerance when investing to achieve financial independence. Risk tolerance measures the amount of volatility an investor can handle emotionally and financially. Investors are classified as aggressive, moderate, or conservative depending on how much risk they can tolerate.

Investors who are aggressive are willing to take risks and have a high risk tolerance in order to potentially achieve better results. The majority of this investor's capital are frequently dedicated to stocks, with little to no bonds or cash.

An investor's time horizon, future earning capacity, and the presence of other assets, such as a home or pension, can also affect risk tolerance. Investors with a longer time horizon may be more willing to take higher risks due to the potential for greater returns, while investors close to retirement are often unwilling to risk their principal investments.

Additionally, investors with larger portfolios may be more tolerant of risk because the percentage of loss is much less in a larger portfolio when compared to a smaller portfolio.

The most important thing to remember when investing is never to take unnecessary risks or exceed one's risk tolerance. Diversifying investments across different asset classes and regions is also wise for better returns. Doing so can help investors achieve their financial goals without taking too much risk.

How To Determine your risk tolerance

Determining your risk tolerance is an important step in achieving financial independence. Knowing your risk profile can help you make better investment decisions and create a portfolio that best suits your goals, objectives, and comfort level.

The first step to determining your risk tolerance is to consider the amount of volatility you are willing and able to take regarding potential investments. To do this, ask yourself questions such as 'What are my investment objectives?', 'When do I need the money?' and 'How would I react if my portfolio lost 20 percent of its value this year?'

Your answers to these questions will help you understand your risk profile. For example, if you invest with a long-term view and expect higher returns, you may have a higher risk tolerance.

On the other hand, if you are close to retirement and looking for more stability and preservation of capital, you may be more conservative with your investments.

It is also important to consider your time horizon when determining your risk tolerance. Money that needs to be accessed shortly should not be invested in high-risk instruments, as there is a higher chance of loss. Conversely, money with a longer time horizon can be invested in more volatile assets for the potential of greater returns.

Finally, risk tolerance assessments and historical return data from asset classes also help inform investment decisions. Risk assessments can provide valuable insight into your risk appetite, while historical returns can help you understand the volatility of different financial instruments and make more informed decisions.

Why Risk Tolerance Is So Important

Risk tolerance is important when investing, as it can significantly impact your portfolio's success. Understanding and defining your risk tolerance allows you to create a portfolio that aligns with your goals, objectives, and comfort level.

An accurate understanding of risk tolerance helps investors make more educated investment decisions. With an accurate risk profile, investors can develop a portfolio tailored to their needs and goals. This ensures the investments stay within comfort levels and take less risk.

Knowing your risk tolerance also allows you to diversify your portfolio accordingly.

Diversifying across different asset classes and regions for higher returns while minimizing risk is important. This is especially important for investors with a longer time horizon as they can take on more risk due to the potential for greater returns.

Risk tolerance is also important when it comes to managing your emotions during times of market volatility. An accurate understanding of your risk tolerance allows you to set realistic expectations regarding the performance of your investments. This helps to reduce anxiety and fear during periods of market uncertainty, as you know your investments are in line with your risk tolerance.

Overall, risk tolerance is an essential factor when it comes to investing. Knowing your risk profile can help you make more informed investment decisions and create a portfolio that best suits your goals and needs.

By understanding their risk tolerance, investors can mitigate risk and manage their emotions accordingly during market volatility. By clearly understanding their risk profile, investors are better equipped to achieve financial independence.

Risk Tolerance vs. Risk Capacity

Risk tolerance and capacity are often used interchangeably, but they are different. While risk tolerance is an individual's attitude towards risk and volatility, risk capacity is an investor's ability to absorb losses without significantly impacting their financial goals.

Risk capacity considers income, age, financial goals, and time horizon. Risk capacity should always be considered when determining an investor's risk tolerance.

For example, if the investor has a short time horizon and is close to retirement, their risk capacity would likely be lower than that of an investor with a longer time horizon looking for higher returns.

It is important to note that risk tolerance and risk capacity are not fixed numbers - they can change over time due to changes in financial goals, income, age, or other factors. It is important to re-evaluate one's risk profile regularly to ensure it is up-to-date.

FAQs

What are the 3 factors of risk tolerance?

The three main factors of risk tolerance are attitude (investor's willingness to take risks), capacity (ability to absorb losses without significantly impacting financial goals), and time horizon (short-term or long-term investments). An investor's income, financial goals, and age should be considered when determining their risk profile.

What is an example of risk tolerance?

An example of risk tolerance is an investor comfortable with the potential for higher returns and willing to take on more volatility in exchange. This type of investor would likely have a higher risk profile than an investor looking for more stability and preservation of capital.

What does workplace risk tolerance entail?

Workplace risk tolerance is an employee's acceptance of certain risks when taking on a new project or task. This involves their ability to identify potential risks and make decisions accordingly, as well as their ability to take on responsibility for any resulting losses.

Conclusion

Risk tolerance is an essential factor for successful investing. Risk tolerance is determined by attitude, capacity, and time horizon. By understanding their risk tolerance, investors can create a portfolio that works best for them and achieve financial independence. Additionally, it is important to re-evaluate your risk profile regularly as it may change over time due to changes in financial goals or other factors. Finally, workplace risk tolerance is essential for any employee looking to take on new projects or tasks - understanding the associated risks and taking responsibility for any losses is key.