How the Fear and Greed Index Can Guide Your Investing: Elaborate in Detail

Nov 07, 2023 By Susan Kelly

Introduction

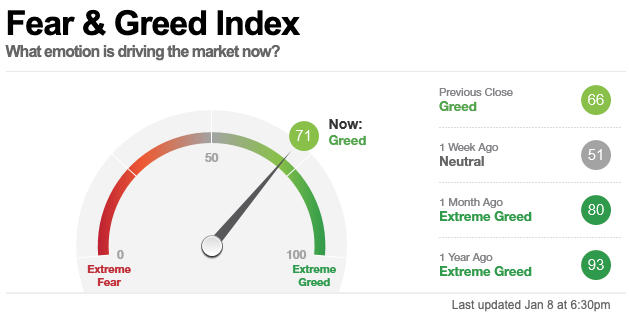

When investing, the stock market can feel the effects of investor emotions like fear and greed. CNN Money's Fear and Greed Index is a multi-factored gauge of stock market sentiment created to determine which of these two emotions may be driving the market at any given time. Many investors don't believe in the Index because it promotes trading rather than long-term investing.

While most investors should avoid market timing to capture short-term gains, the Index can be used to determine when to invest. If you want to achieve this goal, you should consider making your investment at a time when the Index is trending downwards (indicating a time of increased fear). The Fear and Greed Index acts as an early warning system for when rational investors are overpowered by irrational fear.

Understanding the Fear and Greed Index

The Fear and Greed Index is meant to gauge investor sentiment regarding the stock market's current valuation. One could call it a "contrarian index." Stock prices may fall below their intrinsic value due to investors' fear-driven stock sales. If investors are greedy, the opposite is true. Indicators of fear are considered a buy for the Index, while those of greed are considered a sell.

The Fear and Greed Index is meant to gauge investor sentiment regarding the stock market's current valuation. One could call it a "contrarian index." Stock prices may fall below their intrinsic value due to investors' fear-driven stock sales. If investors are greedy, the opposite is true. Indicators of fear are considered a buy for the Index, while those of greed are considered a sell.

Calculation of the Fear and Greed Index

Each of the seven components that make up the Fear and Greed Index is given equal weight in calculating the Index's overall value (which ranges from -100 to +100). These seven elements are:

Stock Price Strength

Quantity of NYSE stocks reaching new highs as compared to those falling to new lows over 52 weeks. The opposite emotion, fear, is indicated when more stocks are making new 52-week lows than new highs.

Stock Price Breadth

Increased trading activity for rising stocks compared to falling stocks on the New York Stock Exchange. As measured by the volume of transactions, traders' actions can be used to infer their emotions.

Market Momentum

The percentage change in the S&P 500 from its 125-day moving average. Greater relative performance indicates greed, and the opposite is also true.

Put and Call Options

This is the put/call ratio on the CBOE. If the put-to-call ratio is higher than normal, investors should be wary.

Safe Haven Demand

The rate at which stocks have grown in comparison to bonds. An increase in relative performance can be interpreted as greed.

Junk Bond Demand

The yield differential between high-quality bonds and lower-quality bonds. When the yield spread widens, investors are less eager to purchase junk bonds, indicating heightened anxiety.

Market Volatility

A measure of expected volatility calculated by the Chicago Board Options Exchange (CBOE). The opposite of a low VIX value is confidence.

Dos and Don'ts of Using the Fear and Greed Index

If the Fear and Greed Index is so helpful, why do we need it? Similarly, taking the temperature of any given environment can be useful. When markets look overheated, and the herd seems to be overvaluing assets, some investors try to sell, and vice versa, to be contrarian.

Do's

The Index can help you see that investing is not a game you should play emotionally. Using it, you can gauge the best time to enter the market. If, for example, you've been keeping an eye on stock and have noticed that it's become even more undervalued as investor fear has increased, this might signal a good time to buy.

Don'ts

To avoid making investment decisions based solely on the Fear and Greed Index or similar investor sentiment indicators, consider other factors. It's crucial to keep an eye on the fundamentals, such as the rate of economic expansion and the earnings and revenue growth of the companies you own. Instances where all seven metrics flash greed are possible, include the FGI. Nonetheless, if the economy is humming nicely, with businesses hiring and consumers spending freely, then such unbridled optimism might be appropriate.

Conclusion

An indicator of market emotion, the fear and greed index shows how investors feel about current market conditions. CNN Money, CNN's money-related division, created it. The Index uses multiple sub-indexes to determine whether or not the market is highly afraid or greedy. Therefore, this data is utilised by anyone involved in the financial markets. A value of zero indicates an index of 100.

Investors are exceedingly afraid when it's at zero, and when it's at 100, they're tremendously greedy. Among the many indicators available for measuring market emotion is the "Fear and Greed" index. Investors typically use it to have a contrarian perspective of the markets, buying when others appear afraid and selling when others appear greedy. Although it might help decide when to make certain investments, it shouldn't be the sole factor in making financial commitments.